Paying for Climate Change: A Reinsurance Industry View

The reinsurance industry insures insurance companies to help reduce the risks associated with underwritten policies. Insurance rates have risen in areas with extreme weather events.

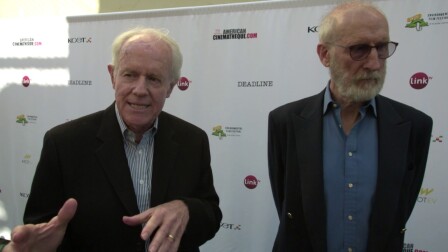

Frank Nutter, president of the Reinsurance Association of America, says climate change is a big factor for reinsurance and insurance companies.

"The consequences of climate change are quite real to our industry and it will have a significant impact on the economy going forward," he said.

From the underwriters' perspective, encouraging people to build on coastal areas, barrier islands, and other high-risk locations inevitably raises the risk level and the exposure of not only property values — including high value homes — but the cost of repair, and recovery of property and public infrastructure as well.

"The cost of climate change has to be factored in both in public and private insurance," Nutter said. Also of concern — wildfires exacerbated by climate change that expose more and more homes and businesses to losses covered by insurance of federal disaster assistance.

Nutter calls for a long-term investment in mitigating losses, better land use planning, better building codes, greater use of green infrastructure to protect properties, and a change in philosophy in government.