Leadership for Urban Renewal Network: An Organization Providing Small Business Owners the Help They Need

City Rising is a multimedia documentary program that traces gentrification and displacement through a lens of historical discriminatory laws and practices. Fearing the loss of their community’s soul, residents are gathering into a movement, not just in California, but across the nation as the rights to property, home, community and the city are taking center stage in a local and global debate. Learn more.

On a Saturday, I began my walk at the corner of Olympic Boulevard and Central Avenue in Los Angeles, an area that is fondly referred to as the Piñata District. Immediately, I was greeted by familiar smells: the richness of carnitas, the smokiness of al pastor tacos and the sweetness of freshly cut fruit. As I continued to walk, I heard music reminiscent of my childhood blasting on multiple speakers; so loud that it almost drowned out the business transactions. Beautiful arrays of colors from the hundreds of displayed piñatas and children’s toys called my eyes in various directions. After walking for some time, I finally came across the ice cream vendor who recently applied for LURN’s Semi’a Fund, a low-interest loan that is designed to support entrepreneurs to strengthen their business.

He showed off his ice cream stand with immense pride and introduced me to the neighboring entrepreneurs. They shared with me, stories about helping one another when the police and city inspectors have raided the business corridor. When one vendor receives a text message from another vendor, they alert others and help place each other’s equipment inside their vehicles before clearing out.

After a few laughs and some sighs of relief from the storytelling, the vendors returned to tending to their businesses and I refocused on purpose of my visit. I was there to better understand the business model, product and the viability, which of course required a tasting! The vendor offered me a scoop of ice cream, one of thirty homemade flavors. I noticed the attention to detail my cup had, a decorative vanilla wafer to complement the pecan flavor ice cream. One bite and the pecan flavor was buttery and sweet just like eating the real thing. After enjoying my ice cream, I walked back to my car wondering about the businesses I met. How can we better assist these businesses? How can existing resources support street vendors in expanding their business?

The City of Los Angeles is the only major city in the United States that does not have a street vending permit system. After a long five-year battle, the campaign, in February, successfully helped pressure L.A. City Council to decriminalize street vending, which means you can no longer be charged with a misdemeanor for sidewalk vending. While this is a major win, the recently released City budget did not allocate resources towards a street vending program that would implement a sidewalk permit system to vend. Now, the attention has shifted to create a permit system for the City’s estimated 50,000 street vendors. This year, the day after Mother’s Day, street vendors prepared an action to respond to the City budget’s lack of funds for a permit system program by cleaning the streets beginning in the San Fernando Valley, into Pico-Union, then South L.A., and ending their caravan at the Piñata District. The message was clear: street vendors are demanding a permit system and want to demonstrate that they too contribute to the fabric that makes communities vibrant.

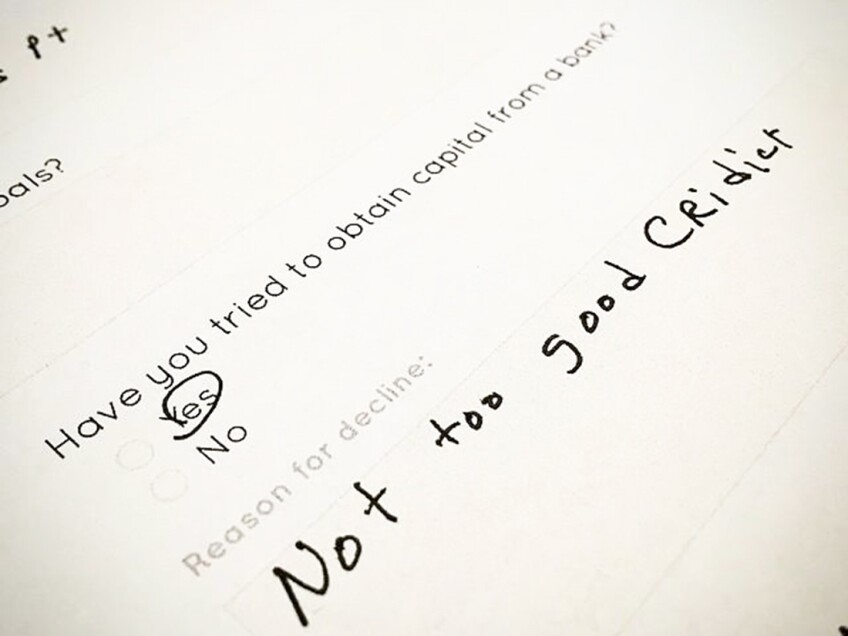

LURN (Leadership for Urban Renewal Network) is working to address income inequalities through entrepreneurism. Early on, the organization was a space that gathered young professionals across the city to address urban issues like street vending. After formalizing these social gatherings into a nonprofit organization in 2013, LURN expanded its interest in helping small business in low-income communities. The L.A. street vendor campaign served as an inspiration to the organization’s existing capital programs such as our micro-loan program. The organization’s main outreach efforts are entrepreneurs at the “bottom of the pyramid” who often have difficulties accessing working capital. As seen in a survey conducted by Pepperdine University’s Private Markets Capital Project, lenders and investors stated they turned down 73% of loan and investment requests based on the cash flow of the business. Likely the reason why the majority of the entrepreneurs that LURN serves do not consider pursuing business loans from traditional banks. Coupled with one frequently cited concern is the entrepreneur’s undocumented status. In addition, many of these street vendors use non-traditional methods to track their business sales and expenses, making it difficult to show lenders and investors their business profit margins. However, LURN has been leading new and original lending practices that break away from institutionalized conventions. Unlike traditional lenders, our application process is centered on getting to know the applicant.

More on Small Businesses

After only one year, our micro-loan fund program has received 100% repayment from borrowers, demonstrating to the lending industry that there is an opportunity to assist entrepreneurs in the informal economy. Furthermore, 40% of borrowers don’t have credit histories and the fund’s pipeline has an average credit score of 510. Yet, all have made their monthly payments on time. Why? LURN’s loan process consists of applicants sharing their business and personal financials in order to determine if they can afford an additional expense. From income taxes to business receipts, the organization attempts to analyze any financial record the entrepreneur has that will help get a better understanding of the applicant’s financial history. LURN attempts to be adaptable in its lending practices, as the organization continuously seeks to improve its loan product informed by its applicants. But one of the key reasons that staff believe borrowers are paying on time is the intentional relationship building that takes place. One way a connection is established with borrowers is through the coaching services LURN offers, from social media training to formally teaching borrowers how to invoice their clients. This personal relationship LURN is nurturing has helped strengthen and shape our lending program. In addition, the loan has deployed $150,000 and we are looking forward to expanding our program by offering loans to a diverse pool of small businesses or micro-entrepreneurs.

Of course, there is still a lot of work ahead! Keeping true to the initial inspiration of the Semi’a Fund, LURN’s micro-loan portfolio consists of 60% street vendors. When the street vending permit system finally gets approved, we need resources in place to protect these entrepreneurs from predatory lenders who may take advantage of “risky” borrowers. The Los Angeles Times recently published an article that reported immigrants over the years experienced targeted aggressive marketing campaigns that pushed “triple-digit loans.” How can we protect our communities from these lending practices? Furthermore, there is a need to see that street vending and señoras catering at home are businesses. How can existing resources and services be offered to these businesses immediately? As an organization, LURN is committed to growing and scaling the Semi’a Fund. But we also need financial institutions to change how they define and view businesses. LURN’s micro-loan program is beginning to bring back the capital our communities need.

If you would like to learn more about LURN and the Semi’a Fund, please visit: www.lurnetwork.org.

Top Image: Shoppers looking at the wares for sale at LURN's "Alternative to Black Friday" themed Artist Marketplace in 2016. | LURN

If you liked this article, sign up to be informed of further City Rising content, which examines issues of gentrification and displacement across California.