L.A. Street Vendors Left out of Federal Aid

The following article was originally published April 15, 2020, and republished through a collaboration with KPCC and LAist.

Story by Emily Guerin

Small business owners across Southern California have spent the last two weeks scrambling to apply for federal coronavirus stimulus funds. But many of L.A.'s most visible and colorful entrepreneurs are left out: street vendors.

Many people selling clothes, flipping tortillas, or serving plastic cups of fresh fruit on street corners around L.A. are undocumented, may not use bank accounts, or lack the proper financial documentation to prove they've been affected by the coronavirus.

"Unfortunately, street vendors are anonymous," Lucas Tax told me over the phone, in Spanish. He previously sold toys and slime, which he said is "muy popular con los niños," in Exposition Park.

"That's why many vendors are still going out to the street, and I understand that, although they're risking their lives," he said.

NOT CLEAR CUT

There has been a lot of confusion over whether undocumented business owners are eligible for government help.

At first, it seemed clear: the application form for the federal Paycheck Protection Program, which allocated nearly $350 billion in forgivable loans to small businesses under the Coronavirus Aid, Relief, and Economic Security (CARES) Act, had a citizenship question. If you were not a citizen or legal permanent resident, you could not apply.

But that question disappeared from the form on the night of April 2, the day before banks began accepting loan applications from small businesses (I tweeted a picture of the question before it was removed).

Other people who cannot receive small-business loans tomorrow: non-citizens. pic.twitter.com/RkeFv2cDwP

— Emily Guerin (@guerinemily) April 2, 2020

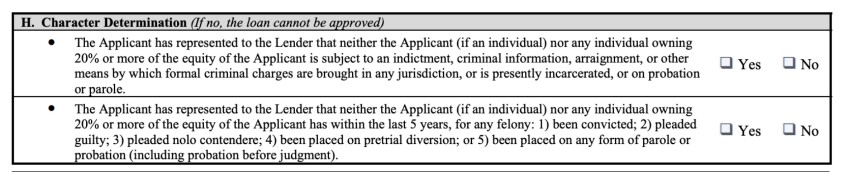

Now, undocumented business owners have a trickier question to answer: are they "subject to an indictment, criminal information, arraignment, or other means by which formal charges are brought in any jurisdiction?"

Sean Salas, co-founder of L.A.-based Camino Financial, which lends almost exclusively to Latino business owners, half of them undocumented, said the question could put applicants without legal immigration status at risk of fraud if they answer "no."

"I like saying the word undocumented, but there are people who call them illegal immigrants," he said.

For this reason, Salas advises his undocumented clients not to apply for the Paycheck Protection Program — even if they pay taxes every year. (At least half of undocumented immigrants are estimated to pay taxes.)

'IF THEY CAN'T WORK, THEY CAN'T LIVE'

Undocumented immigrants are also shut out of another major form of federal aid: the CARES Act's one-time $1,200 payments.

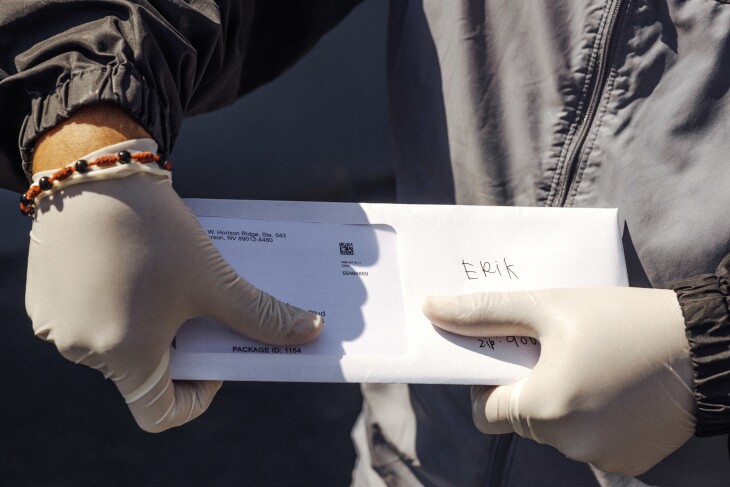

This is why Rudy Espinoza began handing out cash cards to street vendors from a parking lot in Boyle Heights.

Espinoza started his Street Vendor Emergency Fund when the L.A. City Council banned most vendorsfrom city streets last month to help prevent the spread of COVID-19.

"We understand why there has to be bans," he said. "We just want, in addition, for there to be an apparatus to get support for folks. Because if they can't work, they can't live."

Espinoza has raised $140,000 so far from his GoFundMe campaign and a few large charities like United Way. He has already given out nearly 200 cash cards, loaded with $400 each, to street vendors to use for whatever they need.

He's noticed, though, a lot of people asked if they could use it to pay rent.

LUCKY TO AFFORD NOT TO WORK

Tax, the toy vendor, is one of the street vendors who swung by Espinoza's parking lot last Friday to pick up a card.

To keep at bay the stress and boredom of being holed up, Tax has been making the smiley-faced balls he used to sell to kids. He feels fortunate that he can afford not to be on the streets right now, although he said money has been tight.

"It's like we're going back to pre-Hispanic times," he said on the phone, laughing. "We have to cook and grind our own corn to make tortillas."

Tax said he hasn't received any help beyond the cash card and various food donation programs.

"I think it's the big companies that are going to receive help, they're the ones that have priority," he said.

FILLING IN THE CRACKS

California officials seem to realize that undocumented business owners are falling through the cracks.

Earlier this month, Gov. Gavin Newsom allocated $50 million to an existing loan guarantee program for small businesses through the California Infrastructure and Economic Development Bank. Business owners without legal immigration status are eligible for the loans.

"We're trying to cast a net that catches the people the federal programs miss," said Emily Burgos, who runs the program.

On Tuesday, the L.A. County Board of Supervisors voted to create its own loan programtargeting "immigrant-owned businesses and businesses that exist outside of the formal economy."

The program, which will begin on April 21, has two goals: to funnel $15 million of federal Paycheck Protection Program loans to small business owners who may have trouble accessing them, and to create a separate, $12 million loan program for business owners who aren't eligible for the federal program at all.

Joe Nicchita, the head of L.A. County's Department of Consumer and Business Affairs, said the program will work with community-based lenders to identify the most vulnerable small businesses and make sure they get access to loans.